New Delhi, November 21, 2025:

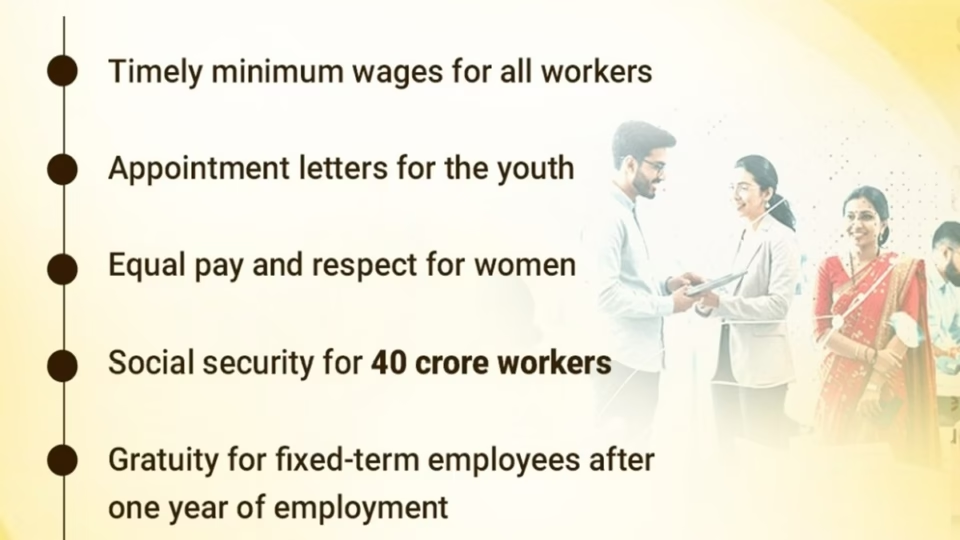

In a landmark reform, the Union government has announced that fixed‑term employees will now be eligible for gratuity after just one year of service, replacing the earlier requirement of five years. The change comes as part of a sweeping overhaul of India’s labour framework, which consolidates 29 existing laws into four simplified labour codes.

Key Highlights of the Reform

- Eligibility Relaxed: Fixed‑term employees (FTEs) can now claim gratuity after completing one year of service.

- Parity with Permanent Staff: FTEs will enjoy the same salary structure, leave entitlements, medical benefits, and social security coverage as regular employees.

- Wider Coverage: The reforms extend protections to informal workers, gig and platform workers, migrant labourers, and women employees.

- Objective: The Labour Ministry stated the move aims to reduce reliance on contract staffing and encourage transparent, direct hiring practices.

What is Gratuity?

Gratuity is a lump‑sum financial benefit paid by employers to employees as a token of appreciation for long‑term service. Traditionally, workers could only access this benefit after completing five years of continuous employment.

With the new rules, fixed‑term contract workers will not need to wait that long. Instead, they will qualify after one year, providing a stronger financial cushion during career transitions.

The Payment of Gratuity Act applies to a wide range of establishments, including factories, mines, oil fields, ports, and railways.

Calculation of Gratuity

The gratuity amount is determined using the formula:

Gratuity = Last Drawn Salary *15/26 * Number of Years of Service.

Here, the last drawn salary includes Basic Pay + Dearness Allowance.

Example:

If an employee’s final salary (Basic + DA) is ₹50,000 and they served for 5 years:

50,000*15/26*5 = ₹1,44,230

Impact of the Change

- For Employees: Greater financial security and quicker access to benefits.

- For Employers: Improved workforce stability and reduced attrition.

- For the Economy: Encourages fairer labour practices and strengthens India’s social security framework.